"Purchased German Automobile Brands Yet Again"

In a recent discussion, portfolio managers Christoph Schmidt, Klaus Kaldemorgen, and Henning Postada from DWS shared their insights on creating a resilient, diversified securities portfolio in today's uncertain market.

Christoph Schmidt, a portfolio manager, highlighted the role of corporate earnings growth in supporting the stock market this year. Meanwhile, Kaldemorgen, a fund manager at DWS with over three decades of experience, expressed concern about the decreasing transparency in the US, comparing it to China's transparency levels.

The DWS Concept Kaldemorgen fund, a multi-asset fund, has an equity allocation of 36%, with a focus on European investment grade securities in the bond segment. The fund has reduced its dollar weighting by two-thirds since the beginning of the year due to the weak dollar. This move has been beneficial for US companies, as the US dollar has lost approximately 10% of its value this year.

Kaldemorgen, a proponent of the tech sector, plans to keep it as an important anchor for the multi-asset fund. However, he advises balancing the tech sector with defensive European stocks and cyclicals. Gold currently stands at 8% in the DWS Concept Kaldemorgen fund, while cash holdings are above 15%.

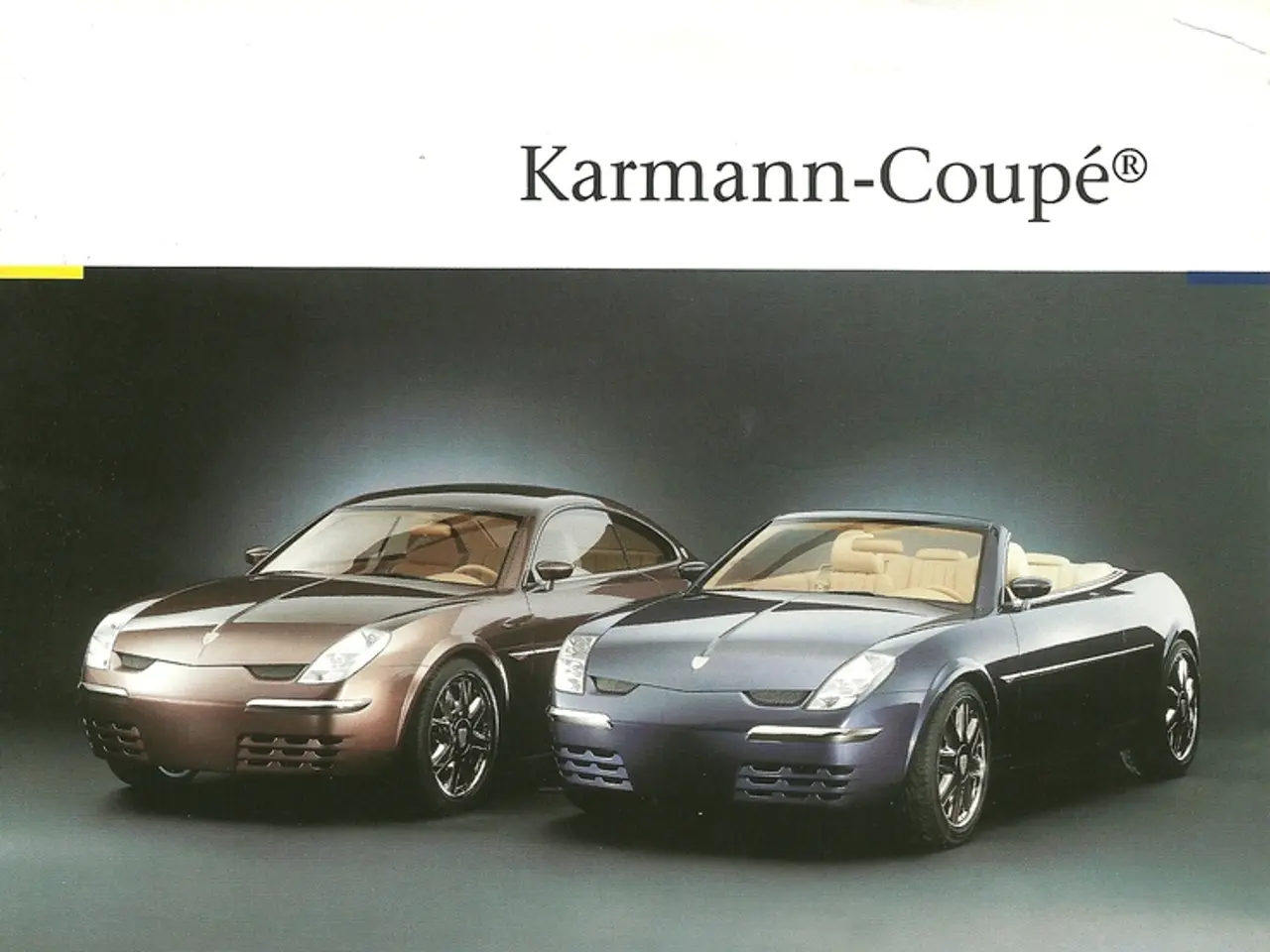

Kaldemorgen has identified the German automotive industry as an undervalued sector with considerable upside potential. He views Germany's infrastructure package positively, but considers recommending infrastructure stocks risky and narrow.

Henning Postada, who manages the fund "ESGA Emerging Consumer Trends" and has been employed there since 2019, attributes this strong performance to a combination of falling key interest rates and sustained modest economic growth. Postada does not believe that inflationary pressure will persist, predicting that it will ease again next year. He predicts that inflation in the US will reach 3% to 3.5% by the end of the year, well above the central bank's target of 2%.

Postada expects the Fed to cut interest rates in September and the ECB to take further action on rates. He believes that, in the current situation, the US labor market is more important to the Fed than inflation, so it will resort to cutting interest rates, which is likely to be at the expense of inflation.

Despite numerous negative factors, such as the DeepSeek shock, US President Donald Trump's actions, tariff increases, and the escalating conflict in the Middle East, many stock indices are trading close to their highs. This resilience is noteworthy, as it indicates a robust market despite the challenges.

Klaus Kaldemorgen, who has been working for DWS since 1982, has been a steadfast presence in these discussions. His insights, along with those of Christoph Schmidt and Henning Postada, provide valuable guidance for investors navigating today's uncertain market.

Read also:

- visionary women of WearCheck spearheading technological advancements and catalyzing transformations

- Recognition of Exceptional Patient Care: Top Staff Honored by Medical Center Board

- A continuous command instructing an entity to halts all actions, repeated numerous times.

- Oxidative Stress in Sperm Abnormalities: Impact of Reactive Oxygen Species (ROS) on Sperm Harm