Dealing with Total Loss Vehicles in Las Vegas

Vehicle Settlement Resulting in Total Loss in Las Vegas

Navigating car accidents in the Las Vegas area can be a daunting task, given the high number of collisions each year. In 2022 alone, a staggering 19,891 collisions were reported by the Las Vegas Metropolitan Police Department, resulting in over 11,071 injuries [source: LVMPD].

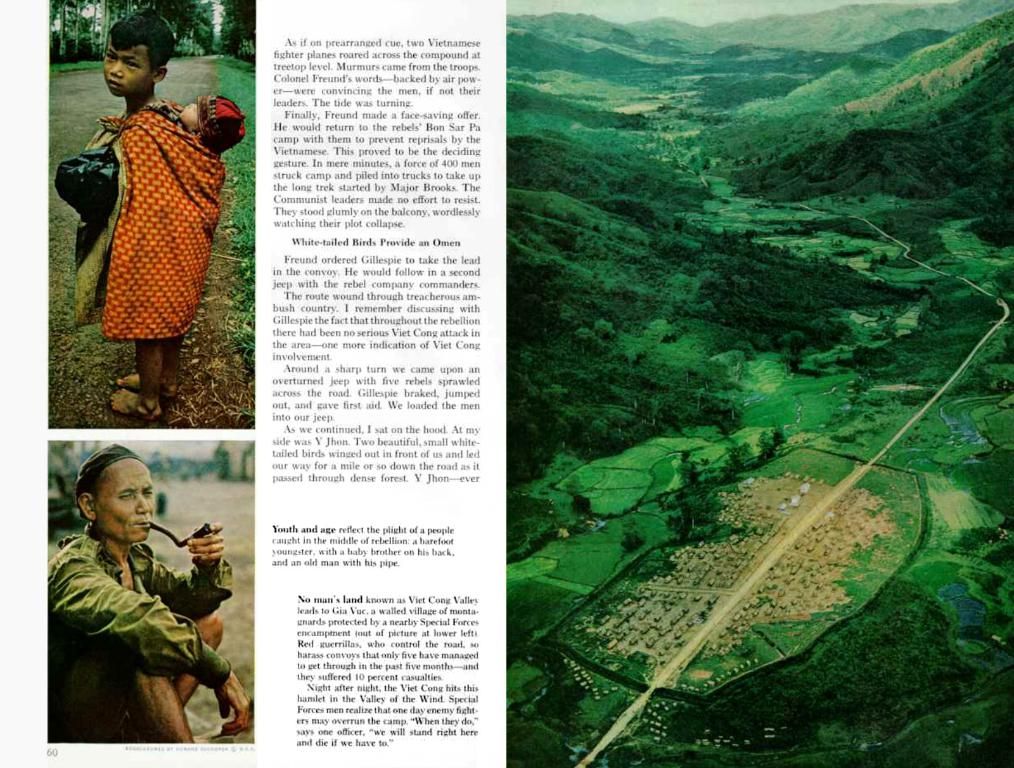

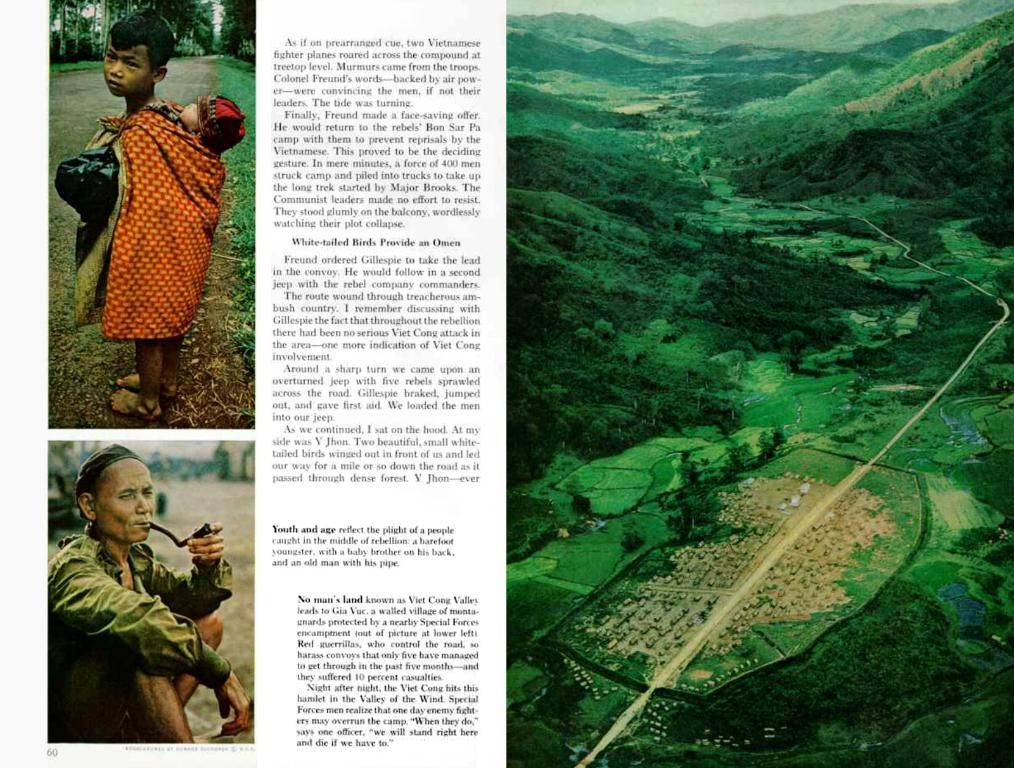

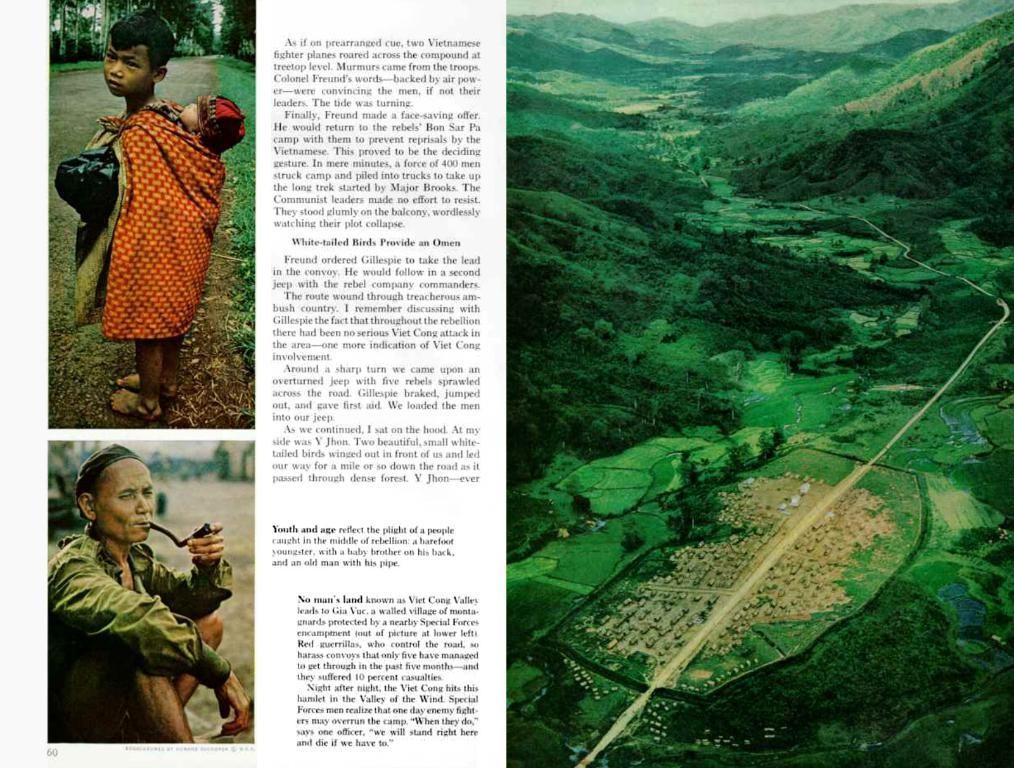

When you're faced with a totaled vehicle, the challenges are more profound. Having your ride compromised in such a way can disrupt routines, bring financial strain, and feel downright disheartening. However, it's crucial to understand your rights and the processes involved in securing fair compensation.

Total Loss Threshold in Las Vegas

In order for a vehicle to be classified as a total loss in Las Vegas, the estimated repair costs should exceed 65% of the vehicle's market value prior to the incident. This criterion serves to ensure transparency in the used vehicle market and protect consumers [source: Nolo].

While a vehicle with under 65% damage might not fall under salvage status, any motor vehicle previously deemed totaled, flood-damaged, or non-repairable officially becomes a salvage vehicle. This label illustrates the vehicle's unfit state for typical operation or repair [source: DMV.org].

Keeping a Total Loss Vehicle

Post-accident, Nevada's salvage vehicle laws allow individuals to retain their totaled vehicle, but be aware of the implications.

Claiming compensation for the car, however, will include a deduction for the salvage value. Reaping the benefits of a DIY repair job is all on you. Furthermore, you can expect a salvage title to be appended to your vehicle, and subsequently, you can register and sell it after proper procedures are followed [source: AAA].

Total Loss Vehicle Settlement Calculation

Insurance companies are tasked with evaluating the total loss vehicle based on fair market value before the collision. The decision to declare it totaled is made when repair costs surpass the value of the vehicle or it's deemed unsafe to drive, even after repairs.

It's common for the settlement to be less than the original purchase price, considering depreciation reduces the payout [source: Nolo]. In most scenarios, the insurance company pays off any outstanding loan or lease, but you might still be liable if there's a balance.

Undervalued Total Loss Settlement

If you suspect your insurance company is undervaluing your vehicle, stand up for your rights and ensure fair compensation. Consult an experienced Las Vegas auto accident attorney who can interpret the law and facts to get the insurance company to adjust the valuation [source: Nolo].

Pro Tips

- Acquiring a copy of your accident report like Henderson accident reports can provide crucial documentation to support your claim during negotiations [source: BMV].

- Gap insurance is a valuable asset that can help cover the difference between your car's fair market value and the remaining amount owed on a lease or loan [source: Insurance Information Institute].

- Be prepared for the possibility of a disputed settlement amount or vehicle condition and keep an eye out for potential manipulation by insurance companies [source: Forbes].

- In Las Vegas, navigating the General News surrounding car-accidents, especially the concerning 19,891 collisions reported in 2022 by the Las Vegas Metropolitan Police Department, can be challenging, given the high number of accidents.

- A totaled vehicle in Las Vegas not only disrupts routines and brings financial strain but also becomes a salvage vehicle if the estimated repair costs exceed 65% of the vehicle's market value prior to the incident. If you claim compensation for such a vehicle, you might face a deduction for the salvage value, making it crucial to understand your rights and the processes involving securing fair compensation.